ChinaFICC’s products deliver execution and trade management solutions for international investors in the Chinese markets

To grow their exposure to these important markets

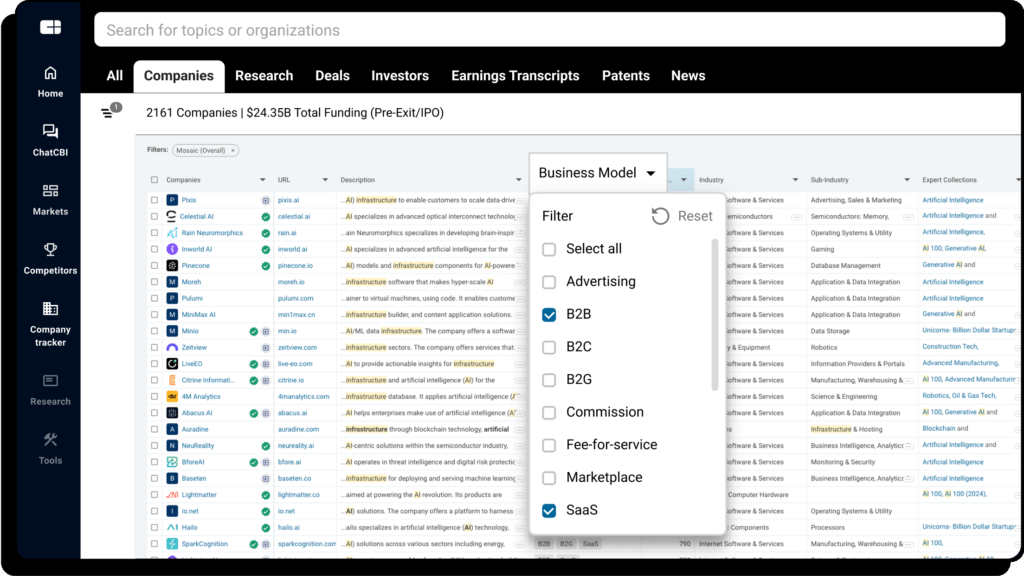

To increase automation

To reduce costs and risk

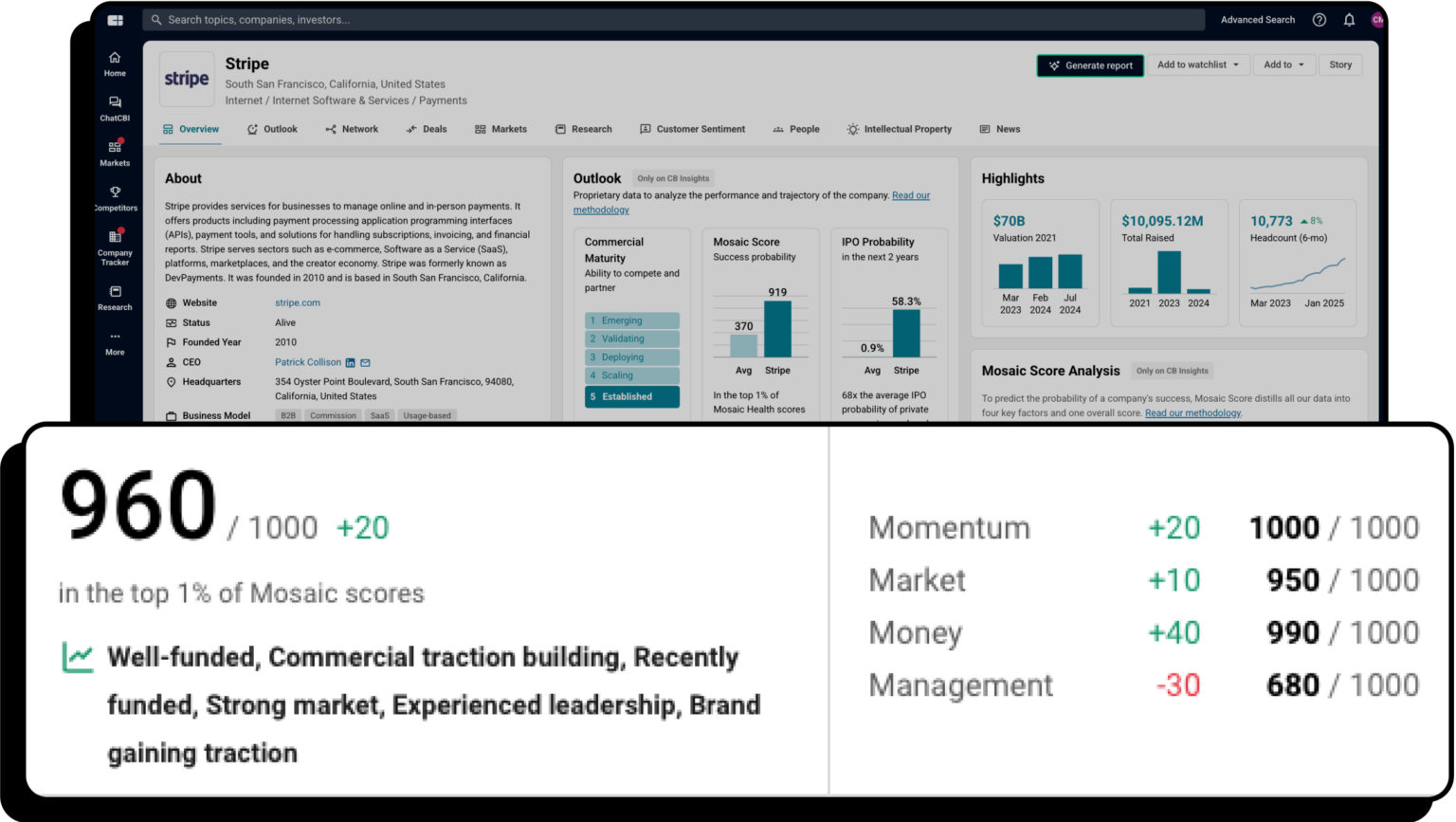

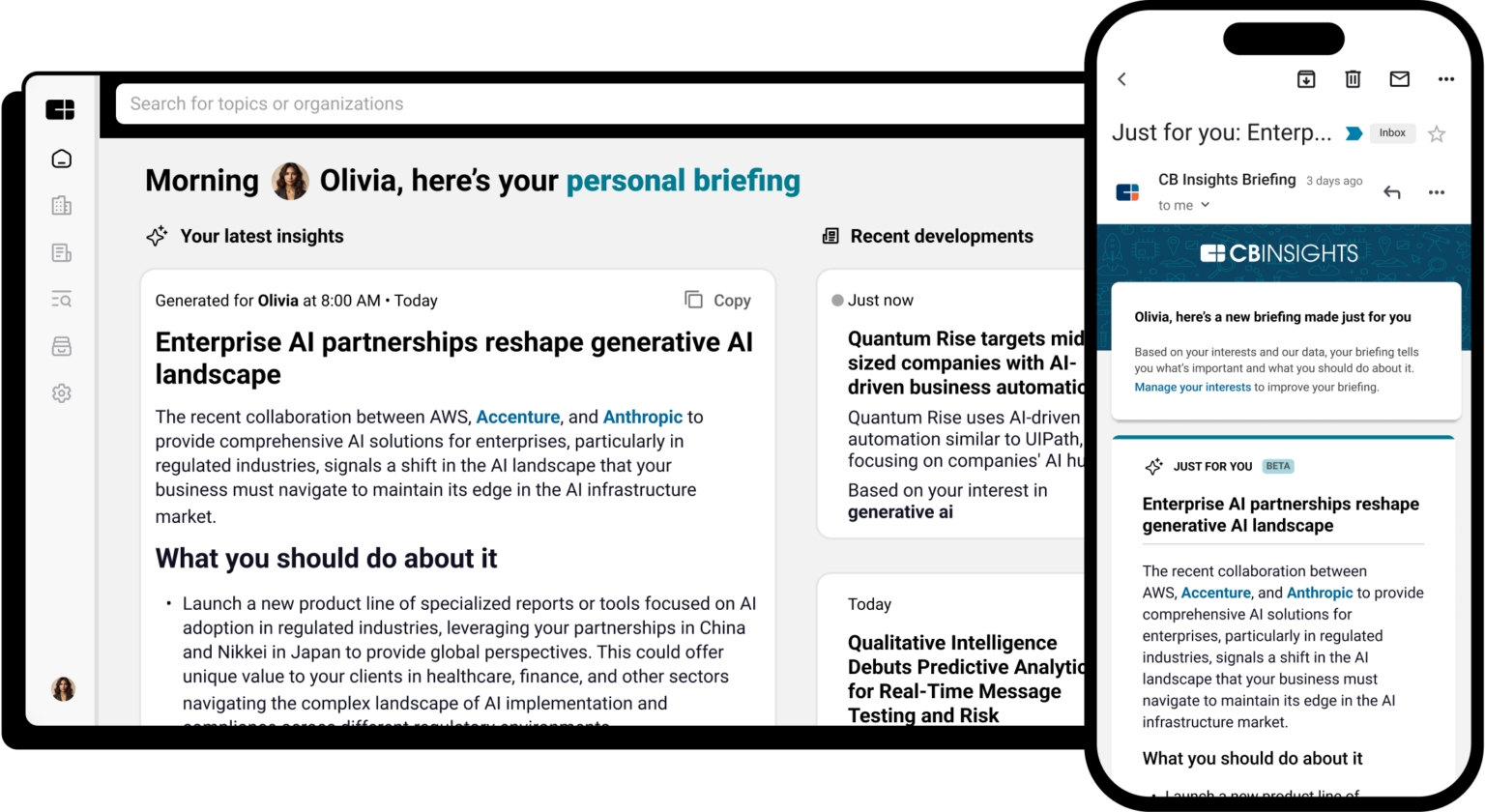

Our platform and services are developed using the latest technologies to be highly performant, scalable, and adaptable

ChinaFICC aims to become a multi-jurisdictional regulated venue and is in the process of acquiring authorizations to operate in HK, Singapore, UK, US and other major financial centres.

As a fully regulated venue, ChinaFICC will be well positioned to assume all regulatory obligations and will not only meet all relevant Western regulatory requirements, but also aims to

establish itself as a fully approved regulated entity to meet China’s regulatory requirements.

Our first solution seeks to address the access, control and competitive issues surrounding participation in the domestic

RMB market (CNY) for international investors in the Bond and Equity markets

User Benefits

Experts in Western and Chinese financial markets and infrastructure, we use our outstanding relationships to navigate China’s markets and regulatory landscape, connecting East and West

Improved Portfolio Returns

by unlocking price competition to tighten spreads, by reducing hedging costs through the use of CNY, and by driving increased competitiveness through transparency

Reduced Risk

by removing the need for unnecessary basis/tracking risk (CNH vs CNY) and automating workflows to reduce operational and regulatory risk

Full Audit and Control

through transparent and auditable execution via end-to-end automation and giving full control of execution to the buy-side trading desks

Compliance Assurance

to currency restrictions and access scheme reporting requirements, adapting to changing regulation as it happens

Operational Efficiency

by reducing cost and increasing efficiency by optimising order and execution management